Satispay officially enters the world of investment and does so with the aim of making instruments often perceived as complex and difficult to use accessible to all.

The new service will allow its more than 5.5 million Italian users to start investing as easily as they pay for a coffee today, with no minimum amount and the flexibility to put in and withdraw money whenever they want.

“Today we open another important chapter in the vision that has guided us since the beginning. We started by simplifying payments and we want to do the same with the investment world. When we introduced the Savings feature in 2018 we immediately found great enthusiasm from our users and now with more than one million people who have set aside savings of over 250m euros in piggy banks over time we are ready to take the next step together with them says Alberto Dalmasso, co-founder and CEO of Satispay, in a note – With our first product, we want to give our current users, and the other Italians who will become them, a concrete tool to value their liquidity and savings in a simple, transparent and flexible way. This is just the first phase of a broader path, with which we want to help democratise access to instruments that give people more value for their money in order to change a culture historically oriented towards savings and too little towards investment’.

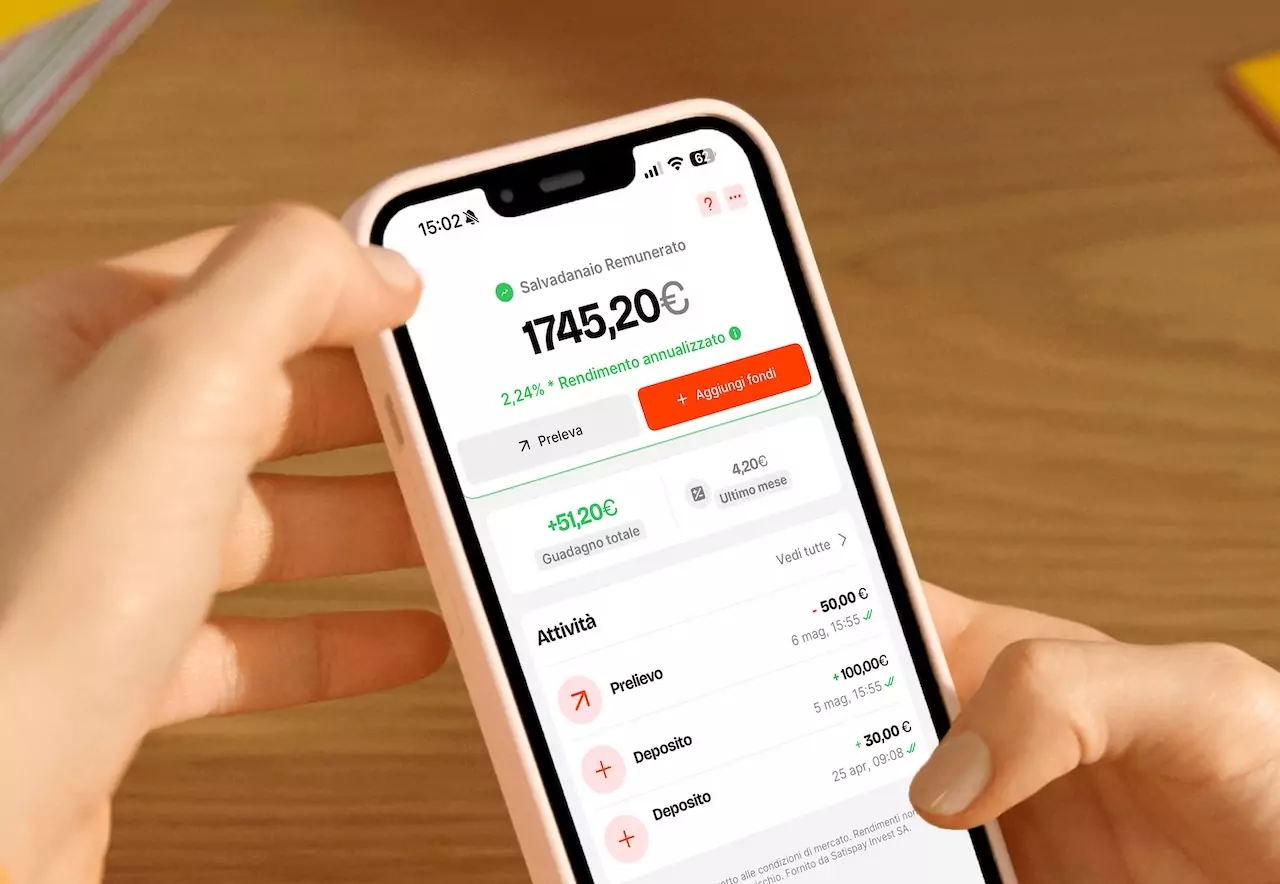

The first product available will be what has been named Salvadanaio remunerato (remunerated piggy bank), designed to help Italians make use of the liquidity sitting idle in their current accounts and based on a monetary mutual fund with a class created in collaboration with Amundi that will allow investment without minimum amounts, with funds redeemable the next working day and taxation managed by Satispay through a partner. This product is designed to offer a stable and competitive return on liquidity, intercepting a concrete need: over 1,360 billion euros of Italians are today parked in current accounts and bank deposits, often without any form of return (source: FABI, 2024).

In a market scenario in which people choose not to invest their savings due to perceived complexity, lack of financial knowledge and fear of losing their money, Satispay aims to remove these barriers that keep people away from the world of investment by supporting its customers both with financial education activities and with one of the least risky products on the market perfectly integrated within the app they already use every week for their payments.

Additional financial products are already under development and will be released by the end of the summer, building an offering that meets the needs of different types of investors, with different objectives and time horizons.

In order to pursue the new objectives and to enable the development of all investment solutions with the highest security standards on the market, Satispay, through its subsidiary Satispay Invest SA, has obtained authorisation to operate as an investment firm from the CSSF, the Luxembourg Financial Sector Supervisory Commission. Investment services are therefore provided by Satispay Invest SA, an investment firm authorised and regulated by the Commission de Surveillance du Secteur Financier (No. P555).

ALL RIGHTS RESERVED ©