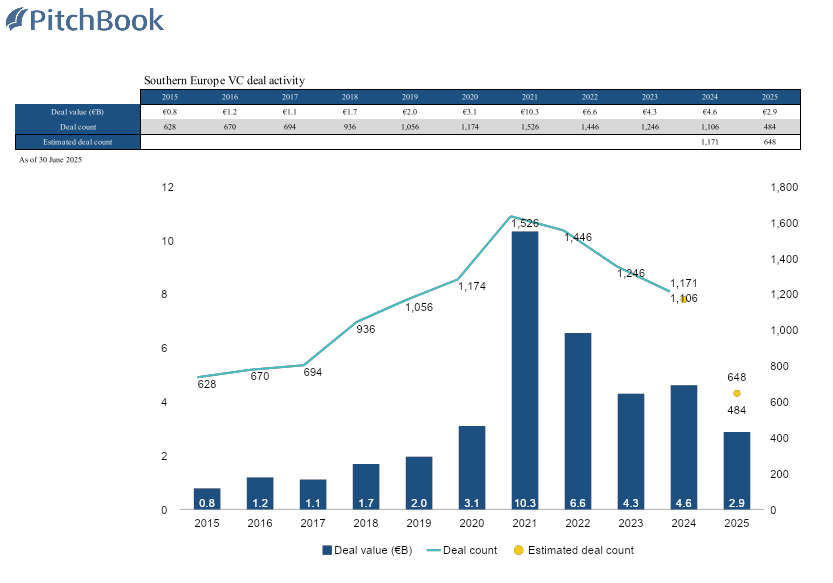

Venture capital investment in Southern Europe, i.e. the area comprising Spain, Portugal, Italy, Greece, Malta, Gibraltar, Andorra, Monaco and Cyprus, is progressing at a faster pace than forecast for 2024.

In the first half of 2025, €2.9 billion was invested, thanks to a steady flow of transactions and an increase in the average size of transactions. Late-stage deals drove the market, accounting for 50% of the regional value, with significant rounds for Tekever in Portugal and Spanish companies such as Auro, TravelPerk and Multiverse Computing. Spain leads the region in terms of numbers, thanks in part to the support of highly active public funds. Other key countries, according to Pitchbook’s Private Capital Breakdown report for Southern Europe in the first half of 2025, are Portugal and Italy.

While US investor participation in the area fell to 12.8%, sovereign wealth funds increased their activity, investing €0.5 billion, exceeding 2024 levels. Artificial intelligence leads the sectors with €1 billion invested, surpassing software as a service (SaaS). Big data and mobile technology gained ground, while cleantech lagged behind. Life sciences and fintech also exceeded the figures for the same period in 2024.

The non-traditional investors account for 75% of the total value of transactions. Exit activity is higher than in 2024. Spain and Italy are recording particularly high volumes, driven by acquisitions and buyouts. . Stock market valuations remain challenging, with PUIG’s performance reflecting a broader European trend of weaker VC-backed IPOs compared to PE-backed ones.

Nevertheless, Spanish stock markets have outperformed since the beginning of the year. SaaS remains the most active exit sector, with artificial intelligence and machine learning driving its value.

The fundraising remained low in the first half of 2025, with only €0.1 billion raised through four vehicles, mainly by emerging managers. Greece’s Marathon VC led the rankings with a €75 million fund for early-stage B2B startups. . The overall fundraising climate in Europe remains weak, although €3.5 billion of capital is available in 20 active funds in Southern Europe, with many closings likely to be postponed until 2026. In this context, Spain’s Axis remains very active, having committed nearly €4 billion through its fund of funds and mobilised €12.9 billion, particularly towards artificial intelligence, cybersecurity and greentech. Axis often acts as a reference LP, providing early validation and attracting private capital.

By 2025, Southern Europe has strengthened its venture capital and innovation ecosystems through a combination of targeted government initiatives and support from EU regulatory frameworks. A key development has been the European Commission’s ‘Choose Europe to Start and Scale’ strategy, which aims to address the systemic challenges faced by start-ups across the continent. Measures such as the standardisation of intellectual property licensing, improved visa regimes for start-ups and reforms to employee stock options have been designed to improve the business environment for scale-ups. Italy, Spain and Portugal have allocated resources to digital transformation, green transition and regulatory reform, laying the foundations for a more favourable environment for venture capital-backed innovation. For example, Portugal’s targeted support for the digitalisation of small and medium-sized enterprises and deeptech sectors is also helping to improve investor confidence and facilitate greater entrepreneurial activity in the country.

Investment activity in the Southern European region is proceeding at a faster pace than last year. In the first half of 2025, investments totalling €2.9 billion were made, representing a growth rate of 24.4% in investment value on an annual basis. Investments were evenly distributed between the two quarters at the beginning of the year, as the median size of transactions in the first half of the year remained stable or increased across all stages. This was supported by large-scale transactions, which contributed to some of the most significant deals across Europe. These include the largest round for Tekever, a Portuguese security-as-a-service technology company, as well as several rounds in Spain that exceeded €100 million in the first half of the year, including those for Auro, TravelPerk and Multiverse Computing. Half of the value of transactions in the region relates to late-stage rounds, with a share that rose from 43% in 2024 and took market share from all other stages.

The first edition of Pitchbook’s half-yearly report on private equity investments in southern European markets can be downloaded at this link.

ALL RIGHTS RESERVED ©