Table of contents

Startup Genome, in collaboration with the Global Entrepreneurship Network, released the Global Startup Ecosystem Report (GSER) 2025 at VivaTech.

The GSER analyses data from more than five million companies in over 350 entrepreneurial innovation ecosystems. The report provides insights into the key trends, investment flows and policy strategies driving the success of entrepreneurial and innovation ecosystems.

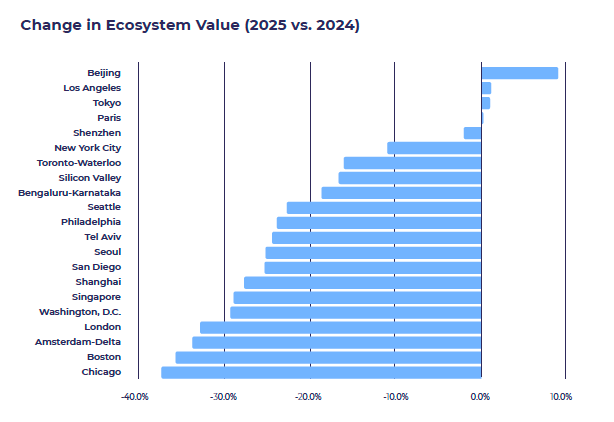

This year, according to the report, is characterised by a major shift with Asia and Africa experiencing strong growth while much of Europe falters. 2025 saw a sharp decline in the value of the ecosystem globally, down 31% in total, marking a significant break from years of sustained growth. The change is closely linked to a decline in exits and IPOs. The report ranks the top 40 global startup ecosystems, the top 100 emerging ecosystems and presents regional rankings. For the first time, GSER rankings include AI that tracks the race to transition startup ecosystems to native AI ecosystems, With 90 per cent of current AI funding concentrated in the US and China, economies that do not rapidly implement targeted entrepreneurial AI policies risk losing billions instead of emerging as the innovation powerhouses of tomorrow.

Further key global findings of the report highlight that: the global disparity in the change in ecosystem value is stark: Asian and sub-Saharan ecosystems saw a 17% decrease, while Latin America experienced an aggregate decline of 45%, Europe 24%, MENA 22%, Oceania 19% and North America 18%. Artificial intelligence and big data rose to become the fastest growing sub-sector, with VC funding increasing by 33%, now accounting for 40% of all global VC investments, up from 26% in 2021.

In last year’s Top 40 ecosystems, the total number of large exits decreased by a worrying 31%. Countering this trend were mainly the Asian ecosystems, Shenzhen, Tokyo, Seoul and Shanghai, along with Paris and Philadelphia. Hong Kong recorded the most significant improvement among all the top 40 start-up ecosystems, jumping from the emerging ecosystem ranking in 2024 to 27th place globally this year. Bengaluru-Karnataka reached 14th place in the top 20 ecosystems ranking, an impressive improvement of seven places from last year. Philadelphia jumped 12 places to 13th, the most significant move of all North American ecosystems in the Top 40.

Paris and Madrid were the only European ecosystems in the Top 40 to improve their ranking, with Paris rising to 12th place following a surge in unicorns and early-stage deals. Although still Europe’s best-performing ecosystem, London dropped one position to 3rd place globally, having shared 2nd place with New York City from 2020 to 2024.

São Paulo remains the only Latin American ecosystem in the Top 40, in 37th place, and leads the region in terms of overall performance. Meanwhile, Mexico City continues to excel among emerging ecosystems. Riyadh recorded the most significant growth in the MENA region, moving from the 51-60 range in 2024 to the 21-30 range among emerging ecosystems, fuelled by strong growth exceeds USD 50m. Cape Town and Lagos lead Sub-Saharan Africa, with Lagos leading in funding and Cape Town in talent and experience. Sydney is the best performing city in Oceania, ranking 25th globally, while Melbourne maintained its 32nd place with a 14% increase in VC funding.

“We are at a crucial moment, two years into the AI era, characterised by exponential growth in the startup ecosystem. The values of the ecosystem have decreased by 31%, but some are growing and they are the ones investing in the creation and support of AI native startups (instead of investing 100% in AI infrastructure and adoption). The future belongs to nations and cities that combine a vision with new political action for AI-native start-ups to ride the AI wave. In response, Startup Genome is launching a global policy coalition for entrepreneurial AI to support ministries and government agency leaders,’ says JF Gauthier, founder and CEO, Startup Genome, in a note.

The GSER was created in collaboration with Global Entrepreneurship Network, Dealroom, Crunchbase, Pitchbook, Bella Private Markets and Tracxn and the 2025 edition provides guidance for policymakers, ecosystem leaders and founders to develop evidence-based strategies that strengthen startup communities, the world’s most powerful engine of job creation and economic growth.

“The lesson is unmistakable: the brave change the world. Those ecosystems that move quickly to develop AI-specific strategies will reap the greatest rewards. Those who hesitate risk being left behind as value creation accelerates around them,” says Jonathan Ortmans, president Global Entrepreneurship Network.

Emerging ecosystems

Emerging ecosystems are communities of start-ups in the early stages of growth. The methodology for ranking the top 100 emerging ecosystems is designed to reflect this by showcasing ecosystems that show high potential to become top global performers in the years to come. The factor weights used to rank these ecosystems differ slightly from those used with major ecosystems to reflect their emerging status and emphasise the factors that are most influential in ecosystems that are just beginning to grow. Less weight is given to the number of exits above $50 million, and startup activity is more focused on early-stage funding than in the Top 40 ecosystems.

Wuxi climbed 14 positions to become the No. 1 emerging startup ecosystem, led by a 67 per cent increase in exits above USD 50 million. Jakarta moved up four places to become the No 2 emerging ecosystem overall. Istanbul gained 10 positions due to growth in performance, funding and reach making it the third emerging ecosystem for start-ups. Two ecosystems in the top 15 emerging ecosystems ranking climbed 13 positions: Nanjing in 9th place and Phoenix in 11th. Riyadh experienced the most significant growth of any MENA ecosystem in the Top 100 Emerging ranking, moving from the 51-60 range in 2024 to the 21-30 range this year thanks to strong growth in exits over $50m, including the $1.1bn exit of Rasan.co. Las Vegas climbed a whopping 53 positions, entering the Top 30 ecosystems, Hartford, Connecticut moved from the 61-70 range in 2024 to the 21-30 range this year. Chongqing entered the Top 100 Emerging Ecosystems list for the first time, with two exits exceeding $50 million, placing in the 61-70 bracket. Pune rose significantly from the 91-100 bracket in 2024 to the 41-50 bracket this year. The ecosystem saw a $1bn exit with the acquisition of retail startup FirstCry.com acquired for $2.8bn. Gothenburg, Sweden, made it into the top 100 emerging ecosystems list thanks to two exits exceeding USD 50 million.

Regional analyses

Asia

There are 12 Asian ecosystems in the Top 40. Hangzhou climbed 13 places from GSER 2024, ranking 23rd among ecosystems. Large ecosystem exits above USD 50 million doubled, while exits above USD 1 billion increased by 25 per cent. Shenzhen moved up 11 places from GSER 2024, now ranking 17th, tied with Washington, D.C. Despite an overall decline, exits above $50m increased by 50%, and exits above $1bn also grew, with robotics startup UBTECH being the most valuable exit at $4.8bn. Tied with Boston in 5th place, Beijing is the best-ranked Asian ecosystem in GSER 2025. Unicorn Moonshot AI is the most highly ranked at a value of USD 5 billion. Bengaluru-Karnataka climbed seven places in GSER 2025, supported by four major $1 billion exits and a five per cent increase in India’s GDP. Hong Kong rose from the top 100 emerging ecosystems in 2024 to 27th place in the Global Startup Ecosystem 2025 ranking, thanks in part to the $1.5 billion exit of Bitcoin startup BitFuFu and an increase in the number of patents produced. Exits from Guangzhou exceeding $1bn increased by 200%, with autonomous driving startup WeRide reaching a high of $4.6bn. The number of early-stage funding deals increased by 36%, contributing to the 36th global ecosystem ranking. Mumbai, the 40th global startup ecosystem, ideaforgetech.com had a $340m exit with unmanned aerial vehicle company IdeaForge, and food startup Zepto reached a unicorn valuation of $5bn. Seoul is the top global startup ecosystem in the Knowledge Factor, which measures innovation through research and patent activity.

Europe

Eight European ecosystems are in the Top 40. Although still the best performing ecosystem in Europe, London dropped one position to 3rd place globally. Paris climbed two places to become the 12th global startup ecosystem, supported by a 7 per cent increase in exits above $50m, including BeReal’s $542m exit in 2024. Paris and Madrid were the only European ecosystems in the Global Top 40 to rise in the rankings. All others slipped at least one position. Madrid moved up from the ranking of the top 100 emerging ecosystems in 2024 to 40th position globally this year, tied with Mumbai. The ecosystem produced the same number of exits as the previous year, with eSport company Movistar Riders the most valued exit, with $6.3 billion. Istanbul climbed 10 places, becoming the third largest ecosystem of emerging start-ups thanks to an increase in exits of more than $50m this year. Birmingham, in the UK, moved up to 21st-30th in the emerging startup ecosystem rankings, thanks to an improved metric that measures the size and performance of an ecosystem based on the accumulated value of technology startups created by exits and funding.

Milan appears to be the 14th ecosystem in Europe, while Rome appears in the 26-30 bracket, again in the European ranking. Neither of the two makes it to one of the top 40 positions globally.

Latin America

The top five ecosystems in Latin America are São Paulo, Mexico City, Bogotá, Santiago-Valparaiso and Rio de Janeiro. Ranked 37th globally, São Paulo is the only Latin American ecosystem in the top 40. Rio de Janeiro moved up one position in the top five ecosystems, replacing Buenos Aires in 5th place. Brazil is the most represented country in the top 10 in Latin America, with São Paulo in 1st place, Rio de Janeiro in 4th, Belo Horizonte in 7th, Curitiba in 8th and Porto Alegre in 10th. São Paulo is the No. 1 ecosystem in Latin America in terms of performance, measuring the size and performance of an ecosystem by the accumulated value created by exits and funding. Mexico City is the No. 2 ecosystem in three metrics: funding, talent and experience, and performance. Córdoba recorded a 9% growth in ecosystem value, the only ecosystem among the top five in Latin America to do so.

MENA

The top five ecosystems in MENA are Tel Aviv, Dubai, Riyadh, Abu Dhabi and Cairo. Tel Aviv is the only MENA ecosystem in the Top 40 and remains the leading ecosystem in the region. Dubai is the 19th emerging ecosystem globally and the 2nd MENA ecosystem in talent and experience. Cairo is the #1 MENA ecosystem in terms of early stage startups able to close VC rounds. Tunisia ranks 2nd. Riyadh has made impressive progress, moving from the 51-60 bracket last year to the 21-30 bracket in 2025. It produced a $1bn exit with Fintech Rasan and saw an 11% increase in the number of early stage financing deals. Abu Dhabi moved from the 61-70 bracket in GSER 2024 to the 51-60 bracket this year thanks to Alef Education’s high-value exit at $2.6bn, the number of active unicorns increased and the number of early-stage financing deals is up 48%. Jeddah, AlKhobar-Dammam and Amman entered the top 10 MENA ecosystems this year, ranking 6th, 9th and 10th respectively. Sharjah’s ecosystem value growth in GSER 2025 was 142%.

North America

Seventeen of the top 40 ecosystems are based in North America, with three in Canada and the rest in the US. Silicon Valley remains the top global startup ecosystem, producing the largest number of large exits, with Openai.com being the most valued unicorn at $147 billion. New York City maintained its position as the second largest global startup ecosystem, while London, previously tied for 3rd place. Los Angeles, ranked 7th globally, is the only North American ecosystem within the Top 40 to show positive growth in ecosystem value in 2025 compared to 2024. Philadelphia climbed 12 places to 13th globally, thanks to a 10% increase in exits over $50m. Tmunity Therapeutics was the most valuable exit with $1.3bn. Boston moved up one position and entered the Top Five ranking this year. It is tied with Beijing in 5th place. Toronto-Waterloo continues to dominate as Canada’s leading ecosystem, despite slipping two places to 20th. It is the second largest ecosystem in North America in terms of knowledge, which measures innovation through research and patent activity. Las Vegas has shown incredible upward movement, moving from the 81-90 range in the 2024 Emerging Ecosystem Rankings to the 21-30 range this year, driven by growth in exits over $50 million. Quebec City is the third largest ecosystem in North America in terms of the amount of tech startups close a VC round and the fourth largest ecosystem in North America in terms of talent.

Oceania

The top five ecosystems in Oceania are Sydney, Melbourne, Brisbane, Auckland and Perth. Sydney is the best performing startup ecosystem in Oceania, ranking 25th globally. It is the No 1 ecosystem in Oceania in terms of knowledge, talent and experience, funding, and performance. Melbourne maintained its No. 32 ranking in the global startup ecosystem. Total VC funding in the ecosystem increased by 14 per cent and ConTech’s payments management platform, Payapp, was the highest valued exit at $390 million. Brisbane is the only Oceania ecosystem in the top 100 emerging ecosystems ranking. It is Oceania’s third largest ecosystem in terms of talent and experience, measuring long-term trends on the most significant performance factors and the ability to generate and retain talent in the ecosystem. Adelaide is Oceania’s second largest ecosystem in terms of affordable talent.

Sub-Saharan Africa

The top five ecosystems in Sub-Saharan Africa are Lagos, Nairobi, Cape Town, Johannesburg and Accra. Lagos is Sub-Saharan Africa’s best performing ecosystem, ranking between 61st and 70th in the top 100 emerging ecosystems. Cape Town is Sub-Saharan Africa’s No. 1 ecosystem in terms of talent and experience. Lagos is Sub-Saharan Africa’s No. 1 ecosystem in terms of funding, measuring innovation through early-stage funding and investor activity. It is second in terms of performance, talent and experience. Johannesburg has maintained its position as Sub-Saharan Africa’s No 1 ecosystem in terms of knowledge, measuring innovation through research and patent activity.

The full report can be downloaded here

ALL RIGHTS RESERVED ©